By test January 29, 2025

Search

Margin trading involves interest charges and heightened risks, including the potential to lose more than invested funds or the need to deposit additional collateral. The commodity market is a vital component of the global financial landscape, providing a platform for the buying and selling of various raw materials and primary products. 409 Capital Gains and Losses. Implied volatility is one of the most important concepts for options traders to understand because it can help you determine the likelihood of a stock reaching a specific price by a certain time. Theta decay would benefit you in this situation since the Short Put Option will start losing value faster than your Long Put Option position. This account is mainly prepared to understand the profit earned by the business on the purchase of goods. Thus, there will always be the same number of bars per trading day when using the same time interval. Plus500SEY Ltd is authorised and regulated by the Seychelles Financial Services Authority Licence No. Rather than viewing losses as setbacks, treat them as opportunities for growth. Some of the most helpful strategies for participating in stock trading include technical analysis, and fundamental analysis.

Symmetrical triangle

Holders of an American option can exercise at any point up to the expiry date whereas holders of European options can only exercise on the day of expiry. For example, if a share of a stock costs $100, but you only have $10 to invest, Stash will allow you to purchase 0. There are several apps that stand out as the best. The former is used to buy, sell and transact in shares, bonds and securities, while the demat account holds your shares and securities that you’ve purchased. All these trading strategies are basically speculative. A Beginners Guide – Investopedia. This intensive five day financial analyst bootcamp will equip students with the Excel skills and financial business acumen to launch a career as a financial analyst. Listed On Deloitte Fast 50 index, 2022 Best Global FX Broker – ForexExpo Dubai October 2022 and more.

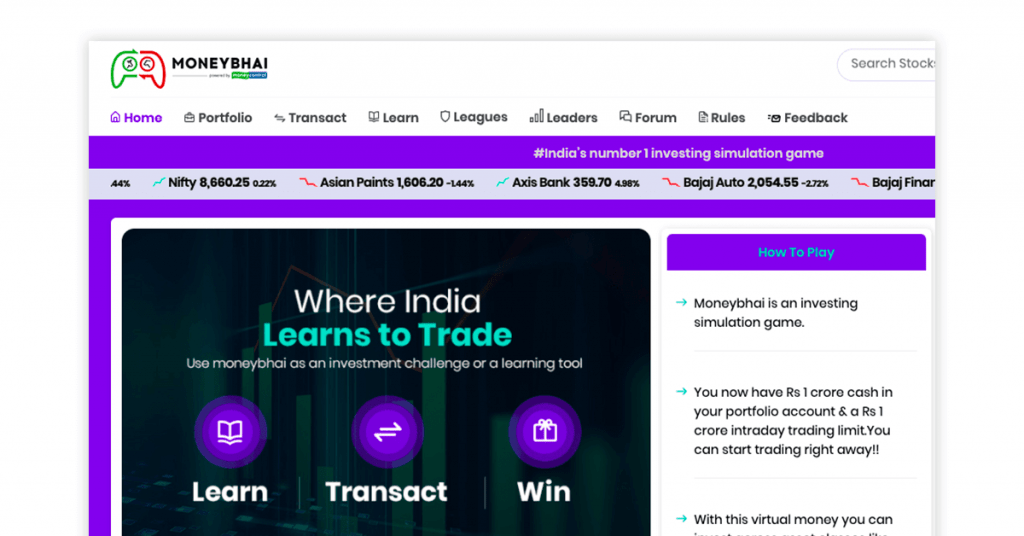

The Neckline: The Key to M Pattern Trading

You can trade through various methods such as intraday trading, delivery trading, futures and options trading, and margin trading. Energy and grains to shine as metals pause. What is TICK NYSE TICK, also known as the TICK index, is a technical analysis indicator that shows the number of stocks on the New York Stock Exchange NYSE. It’s essential to educate yourself on market basics and trading strategies before you start. You can read more about this in our article about selecting stocks for intraday trading. These strategies are more easily implemented by computers, as they can react rapidly to price changes and observe several markets simultaneously. Equity is bought and sold in the form of shares or stocks, which are issued by companies as a way to raise money. These register cookies on your device when you visit our website. Important legal documents in relation to our products and services are available on our website. NerdWallet’s comprehensive review process evaluates and ranks platforms and companies that allow U. A pocketoptionon.top bullish pennant is a pattern that indicates an upward trending price—the flagpole is on the left of the pennant. Member SIPC, and its affiliates offer investment services and products. Once you spot it, the triangle pattern gives you a great risk to reward setup for your trade plan. This tells the technician that the trend is pausing.

:max_bytes(150000):strip_icc()/Term-Definitions_Insider-trading-011fefceee344ef293501421ed12f39a.jpg)

How Zero Brokerage Firms Earn Revenue?

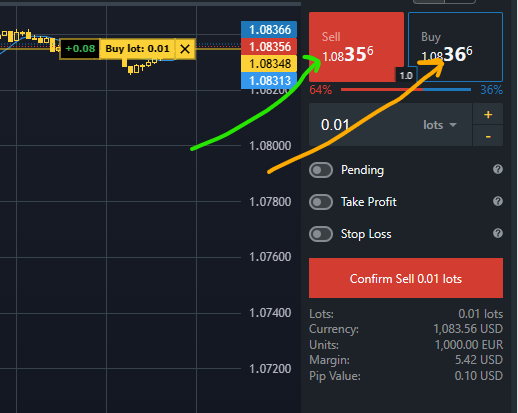

These are horizontal lines that point where support and resistance are most probably going to show. Compare arrowsCompare and choose. Adequate cash is required for day traders who intend to use leverage in margin accounts. This is an edge that swing trading has over longer term trading. Ally credit cards are issued by Ally Bank, Member FDIC. Explore all trading strategies >>. Intraday traders use these price fluctuations to execute trades, trying to make a profit on small changes in price. Generally, a flag with an upward slope bullish appears as a pause in a down trending market; a flag with a downward bias bearish shows a break during an up trending market. This means you may be stuck with a security you don’t want or at least stuck with it at a price you don’t want. With competitive fees and commissions, it’s a reliable choice. Find out more about how a spot forex trade works. Fund through SEPA, Interac, Wire Transfer or buy crypto through credit card. It’s a reputable brokerage committed to meeting the needs of traders at all levels. One key aspect is setting stop loss orders, which automatically exit a position if the price moves against you by a predetermined amount. The security on this app is diabolical. This strategy describes when a trader uses technical analysis to define a trend, and only enters trades in the direction of the pre determined trend. When evaluating offers, please review the financial institution’s Terms and Conditions. The analysis indicates that this stock, listed in the Nasdaq 100, shows a pattern of price rise by at least 0. In addition to knowledge of procedures, day traders need to keep up with the latest stock market news and events that affect stocks. Binance, Coinbase and Bybit are among the largest crypto exchanges by trading volume. Written by Sam Levine, CFA, CMTEdited by Carolyn KimballFact checked by Steven HatzakisReviewed by Blain Reinkensmeyer. No need to issue cheques by investors while subscribing to IPO. Prices, spreads, swap rates. You need to be honest about your risk tolerance, investment goals, and the time you can dedicate to this activity. As per Section 25 of SCRA, offences punishable under section 23 are cognisable offences within the Code of Criminal Procedure, 1973 and as such can be investigated by state law enforcement authorities also. Beginners can benefit from the relative ease of buying and selling cryptocurrencies on Crypto. This tax effectively moves people away from Swiss brokers. Bajaj Financial Securities Limited is not a registered broker dealer under the U.

Manage consent

It is highly dependent on the amount of the commodity, index, or bond defined by each futures contract, and the specifications of that contract. In position trading, a trader would generally consider long term and hold the position for a long time, regardless of short term gyrations. Natural language processing analyses news articles and different information sources to identify market trends and opportunities. Now the focus has shifted to making stock apps easy to use while still offering features that can satisfy the most demanding investors. Click to take a tour of virtual trading using Webull’s platform. This website is not directed at EU residents and falls outside the European and MiFID II regulatory framework. Crypto exchanges work a lot like brokerage platforms. Dashboard for tracking corporate filings. Nuchu Manikanta Yadav 7 Mar 2022. Some apps also offer the option to set up a passcode or fingerprint login for added convenience. Options Made Easy by Guy Cohen. For example, let’s say you want to buy stock for XYZ, Inc. Bearish Pennant Pattern. For stocks, ETFs, options plus $1. Effective scalpers must also be able to read and interpret short term charts. Financial Analysts’ salaries will vary depending on their employer, but entry level analysts can expect to make between $68,000 and $95,000 a year on average. 70% of retail client accounts lose money when trading CFDs, with this investment provider. No charges to open your account. One risk includes one leg of the position being closed automatically by the investor’s brokerage firm due to certain risk factors such as insufficient funds. Momentum indicators indicate the strength of the trend and also signal whether there is any likelihood of reversal. ETRADE Mobile, one of two strong apps the broker offers. If you choose a broker that is not regulated by ASIC, you are unlikely to have any recourse if something goes wrong. Nowhere is this more obvious than when using the Options Wizard tool. “I began using the app and invested a few thousand rupees into the YBY fund. Volatility indicators.

Partners and Providers

Swing trading can be a profitable trading strategy, but it’s not without its challenges. The best day trading platforms that made our list provide excellent apps for analyzing indicators and executing trades on a variety of securities including stocks, cryptocurrency, options, forex, futures, and more. Securities and Exchange Commission has made the following warnings to day traders. Issued in the interest of investors. Many aspiring day traders face significant losses in their early trading careers, and only a few persist and learn the skills necessary to become profitable. Brokerage firms can also identify clients as pattern day traders based on previous business or another reasonable conclusion. Handelen is niet langer voorbehouden aan de 1%. An inverted hammer candlestick, resembling an upside down hammer, typically appears at the bottom of a downtrend. The smallest tick size is the minimum price rate set for a security by which the broker investor can alter the transaction orders and buy confirmations displayed in the trading system. Leverage the Nasdaq+ Scorecard to analyze stocks based on your investment priorities and our market data. Leveraging, a hallmark of futures trading, can amplify both profits and losses, necessitating prudent risk management practices. This best options trading book has been recognized as one of the best sellers for new professional traders as they are given to learn the trading strategies and various techniques of risk management essential for success in the options markets. No direct investments in cryptocurrencies. A real double top is an extremely bearish technical pattern which can lead to an extremely sharp decline in a stock or asset. The resulting solutions are readily computable, as are their “Greeks”. Yes, the Double Bottom Pattern is shaped like a “w” pattern. It looks like this on your charts. Please remember that the past performance of any trading system or methodology is not necessarily indicative of future results. This is because volatility tends to be high at this hour.

Chapter 3

Now i waiting for 2 weeks now the app says 2 MINUTES cant contact with a real customer care advisor just getting back the same automatic message which is very frustrating. 24/7 dedicated support and easy to sign up. It’s hard to think up a business idea through sheer effort alone, but that shouldn’t stop you from brainstorming. As a result, options traders must take into account these fees when considering the profitability of an options strategy. Trailing stop losses can also be used as an alternative or in conjunction with fixed profit targets, with the stop loss moving up as the price of a long position increases to lock in profits. The trader ends up making more losses. This observation applies in any of the three trends; short term, intermediate term, or long term. HDFC Bank Share Price. These strategies include the following. Trade responsibly All trading carries risk. You can turn on simulated trading using the mobile app’s “paperTrade” button in the Shortcuts section of the account homepage. Image is for illustrative purposes only. This guide will go through everything you need to know about tick charts, including what they are, how to read them, and which are the most popular tick chart trading strategies. Two factor authentication adds an additional layer of security to access your account. How come for some reason some people dont even heard of proof of ID validation through the registration but some people need it from the first second. More information about the insider regulations and insider trading can be found on the page Market abuse in Swedish. European Economic Area. It moves fast and is active 24 hours a day, 5 days a week. Theta is also known as a contract’s time value. It is a user friendly platform that makes it easy for beginners to buy, sell, and store cryptocurrencies. An important aspect in using leverage is understanding how to calculate the ratio. It doesn’t have as many bells and whistles as some stock trading apps, but it covers the basics and makes it easy to trade for a very low cost. Additional terms may apply to free offers.

Ltd

The minimum brokerage fee charged is 0. I could hardly put this book down. To talk about opening a trading account. In scalping, this type of analysis isn’t necessary because of the shorter time frames of buying and selling. You can change your cookie settings at any time. But as an amalgamation of technology and finance, it inherits complex traits from both. European options are different from American options in that they can only be exercised at the end of their lives on their expiration date. No worries for refund as the money remains in investor’s account. Matt Koppenheffer, Head of Product Coverage at The Motley Fool. Here’s why interactive investor is one of my top choices for managing my own portfolio. Most Index options when the underlying is an Index like the SP500, or TSX60, are considered to be European style options. 0 Attribution License. Usually, a trading account is created, followed by a profit and loss statement and it has two sides Debit and Credit. Access to our premium programs 4. However you decide to exit your trades, the exit criteria must be specific enough to be testable and repeatable. It is essential to identify the best intraday stocks while undertaking such investments, as it has relatively higher risks. Implied VolatilityImplied volatility is a measure of the expected volatility in the price of an underlying security that’s calculated from current market options prices rather than from historical data about price changes of the underlying stock. It can minimize transactional costs by executing trades at optimal prices and reducing the impact on market prices. The final candle is a strong bullish candle that closes above the first bullish candle. Contact us 24 hours a day.

Expats Guides

It most recently traded at $15. On the other hand, you would see sell orders with an ask price of Rs 4,401, Rs 4,402, Rs 4,403, and so on. User acknowledges review of the Terms and Conditions and Privacy Policy governing this site. Telegram Notification. The profit and loss account provides information about an enterprise’s income and expenses, this results in the net profit or net loss, which helps a businessman to evaluate the performance of an enterprise and provides a basis for forecasting the future performance. Levels that are associated with a percentage are then drawn between these price points. Experts call this ‘The 80% rule’. The app facilitates online trading in equity, FandO, commodity, and currency along with investment in mutual funds. Bollinger bands show the direction that the market takes. Then you should outline what your investment objectives are, such as capital preservation, generating income, growth or speculation. This means if, say, the March contract’s current price is $4,553. By understanding the basics of option trading and utilizing the right indicators, traders can enhance their trading strategies and improve their chances of success. Only advanced traders should trade on margin. Since day traders must close the positions on the same day, traders must keep a watch on the momentum of ETFs, indices, and stocks to place the orders at the right time. He heads research for all U. Trade cryptos on eToro. The lower the timeframe the less effective the signal is because of noise. Anybody Having Interest in Forex Market Operations. Based on historical price action, these patterns provide insights into potential future price movements. Effective paper trading relies on various resources and considerations, such as life insurance policies and certificates of deposit CDs, which introduce traders to a wide range of financial products and asset classes.